Depreciation charge calculator

It provides a couple different methods of depreciation. First one can choose the straight line method of.

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Calculate depreciation for a business asset using either the diminishing value.

First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. Calculating Currency Appreciation or Depreciation. After a year your cars value decreases to 81 of the initial value.

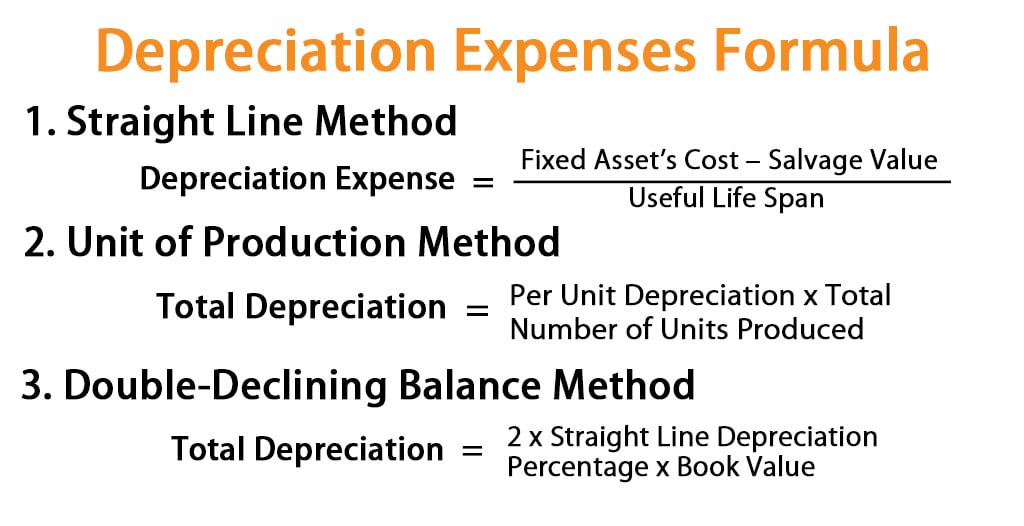

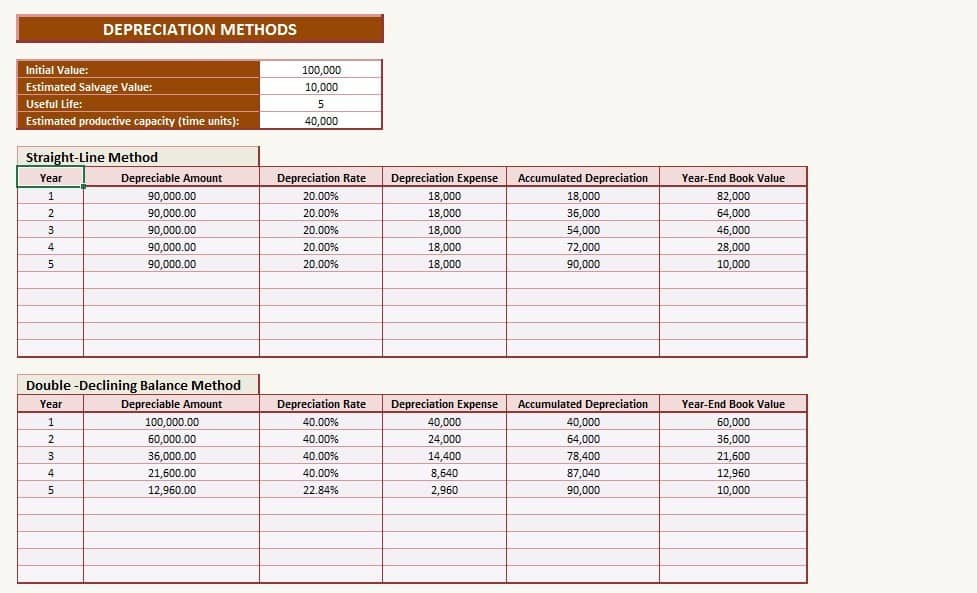

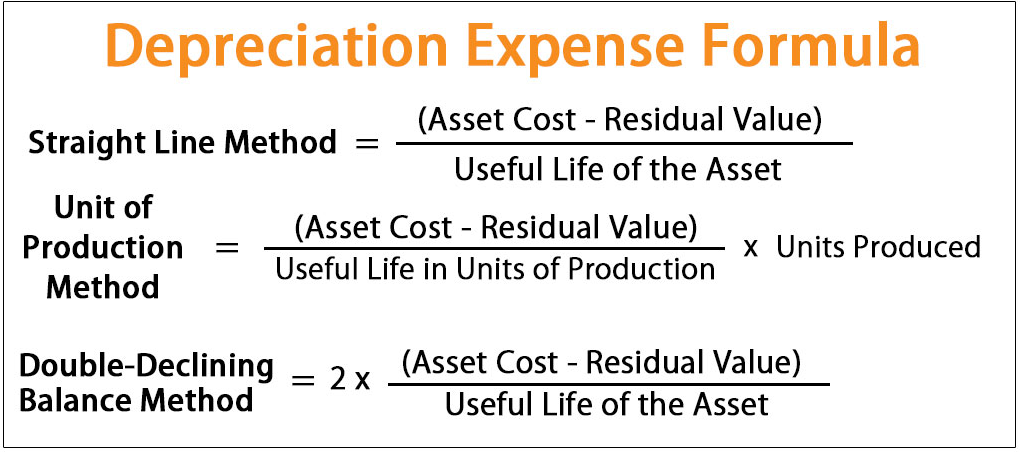

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Find the depreciation rate for a business asset. Depreciable Value per Year Depreciation Rate purchase Price of Machine Salvage Value Depreciable Value per Year 5 500000 100000 Depreciable Value per Year 20000.

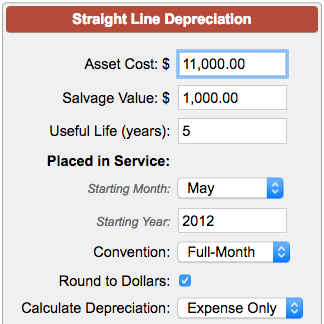

Divide step 2 by step 3. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Therefore the calculation of Depreciation Amount using Straight-line Method will be as follows Using Straight-line Method Cost of Asset- Salvage Value Useful Life of Asset 15000.

If you leave the. The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15.

Given 2 exchange rates in terms of a Base Currency and a Quote Currency we can calculate appreciation and depreciation between them. Our car depreciation calculator uses the following values source. After two years your cars value.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation rate finder and calculator. The MACRS Depreciation Calculator uses the following basic formula.

You can use this tool to. Section 179 deduction dollar limits. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

This limit is reduced by the amount by which the cost of. 80000 5 years 16000 annual depreciation amount Therefore Company A would depreciate the machine at the amount of 16000. This depreciation calculator will determine the actual cash value of your Television - Color using a replacement value and a 12-year lifespan which equates to 012 annual depreciation.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only. This depreciation calculator is for calculating the depreciation schedule of an asset.

There are many variables which can affect an items life expectancy that should be taken. Depreciation Amount Asset Value x Annual Percentage Balance. Calculate the depreciation of an asset using the straight line declining balance double declining balance or sum-of-the-years digits method.

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Calculator

How To Calculate Depreciation Expense Accounting Basics Cpa Exam Content Writing

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Calculator Flash Sales 56 Off Www Ingeniovirtual Com

Depreciation Calculator

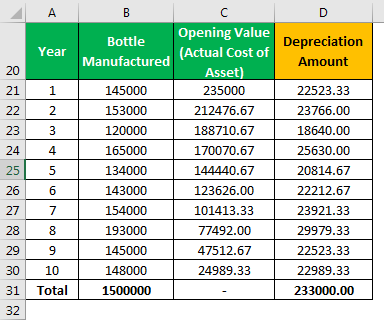

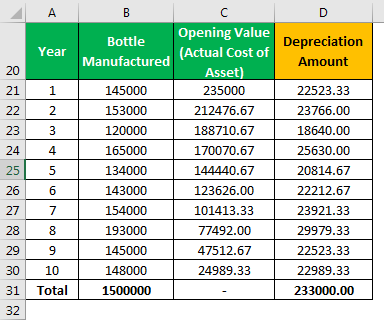

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Calculator

Depreciation Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Calculator Hot Sale 53 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Discount 56 Off Www Ingeniovirtual Com